Treasury Sanctions: Narcotics Networks & Supply Chain Risk

New Treasury sanctions on a Caribbean narcotics network highlight hidden risks in global logistics and visitor management. Learn how to screen for these threats.

New Blog Post · 6-minute read

Most schools think sanctions compliance is a bank problem. OFAC disagrees. A $1.72M settlement shows why your tuition revenue chain is your biggest risk.

In February 2026, OFAC announced a $1,720,000 settlement with IMG Academy tied to 89 apparent violations of counternarcotics sanctions. The issue was not a complicated trade transaction. It was tuition enrollment agreements and payments connected to two Specially Designated Nationals (SDNs), tied to a Mexico-based drug cartel.

This matters because it highlights something most institutions still miss: sanctions risk shows up through everyday business operations, including tuition contracts, third-party payments, refunds, credits, and overpayments.

OFAC’s enforcement release describes a pattern that will feel familiar to any institution with international touchpoints:

The Takeaway: OFAC noted that the SDNs provided full name details that matched SDN List entries. Minimal due diligence during application or enrollment would have revealed the issue. If you accept tuition from the wrong party, you create liability, even if your core mission is education.

Most programs focus on screening the student. That is not enough. A safer model is to screen the full tuition chain of responsibility.

Parent or guardian who signs the tuition agreement.

Payor on the account, including third-party payors or wire originators.

Sponsors, donors, scholarship funders, or agents.

Why? Because sanctions exposure is often attached to the person controlling funds, not the person receiving services.

A practical sanctions control program triggers screening at moments money or contractual obligations change:

Good intentions do not survive audits. Proof does. Your evidence trail needs:

Screen at enrollment, payment, and refund events.

Hold money movements on potential matches.

Require documentation for clear/block decisions.

Export dated evidence for your compliance file.

You do not need to build a huge program on day one. You need a program that works every time.

Get weekly insights on sanctions, export controls, and visitor compliance delivered to your inbox.

No spam. Unsubscribe anytime.

Related posts

More guidance on sanctions, export controls, and visitor management for regulated facilities.

New Treasury sanctions on a Caribbean narcotics network highlight hidden risks in global logistics and visitor management. Learn how to screen for these threats.

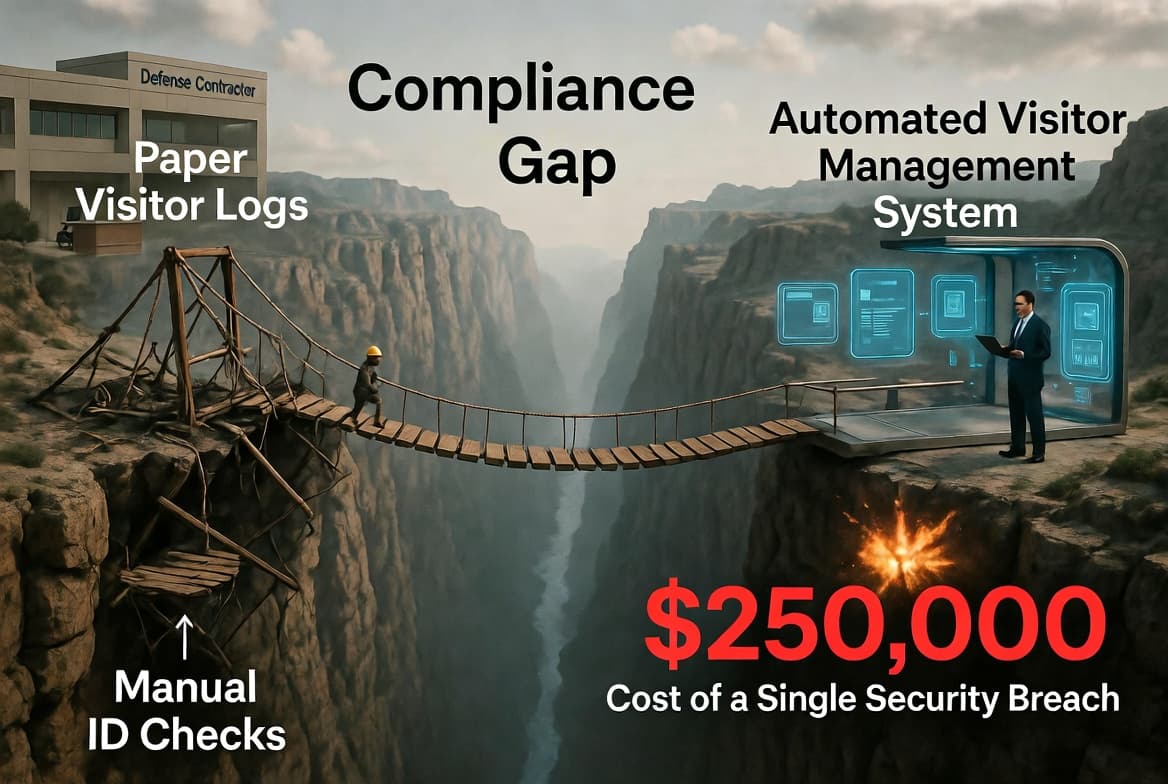

The CEO of "Precision Aero" thought they were ready. Then the auditor asked one question. A cautionary tale about Visitor Management compliance gaps.

DoD is accelerating AI adoption, and defense programs are expanding. Learn what this means for visitor access, ITAR, CMMC evidence, and audit-ready logs.